1. Overview: Trade Policies and Weakened Demand Result in a 9% Decline in China’s Stainless Steel Exports

Throughout 2023, the global manufacturing PMI consistently remained below 50%, indicating a slower economic growth momentum compared to 2022. This led to a recovery with insufficient momentum. Major global institutions generally expect the economic growth rate in 2024 to be slightly lower than in 2023. Geopolitical conflicts continue to cast uncertainty over global trade, which is expected to be a major impediment to global economic recovery in 2024. The stability of global supply chains remains challenged.

According to China Customs statistics, excluding February, China’s monthly stainless steel exports in 2023 were relatively stable at around 350,000 tons. The average monthly export volume from January to November was lower than the same period in the previous two years. From January to November 2023, China’s cumulative stainless steel export volume was about 3.8 million tons, a decrease of approximately 359,000 tons or 8.6% compared to the previous year.

Inflationary pressures and high-interest rates in major stainless steel consumption markets like Europe and America led to weakened investment and consumption dynamics, causing a decline in steel usage in most regions. From January to November 2023, exports to the European Union totaled about 139,000 tons, a 64% decrease, while exports to the United States were about 80,000 tons, down 24.3%.

2. 2023 Trade Policies on Chinese Stainless Steel Products and Goods

The European and American markets, aiming to protect their domestic stainless steel industry, have imposed high trade barriers on imported stainless steel. Notably, in 2023, India emerged as the country with the most significant growth in Chinese stainless steel exports due to increased domestic demand, resulting in historically high export volumes from China. From January to November 2023, China exported approximately 641,000 tons of stainless steel to India, a 30.1% increase. Consequently, India imposed an 18.95% countervailing duty on 200-series stainless steel products from China under tariff headings 7219 and 7220 in April 2023. Indian steel companies have also increasingly called for anti-dumping duties on imported stainless steel.

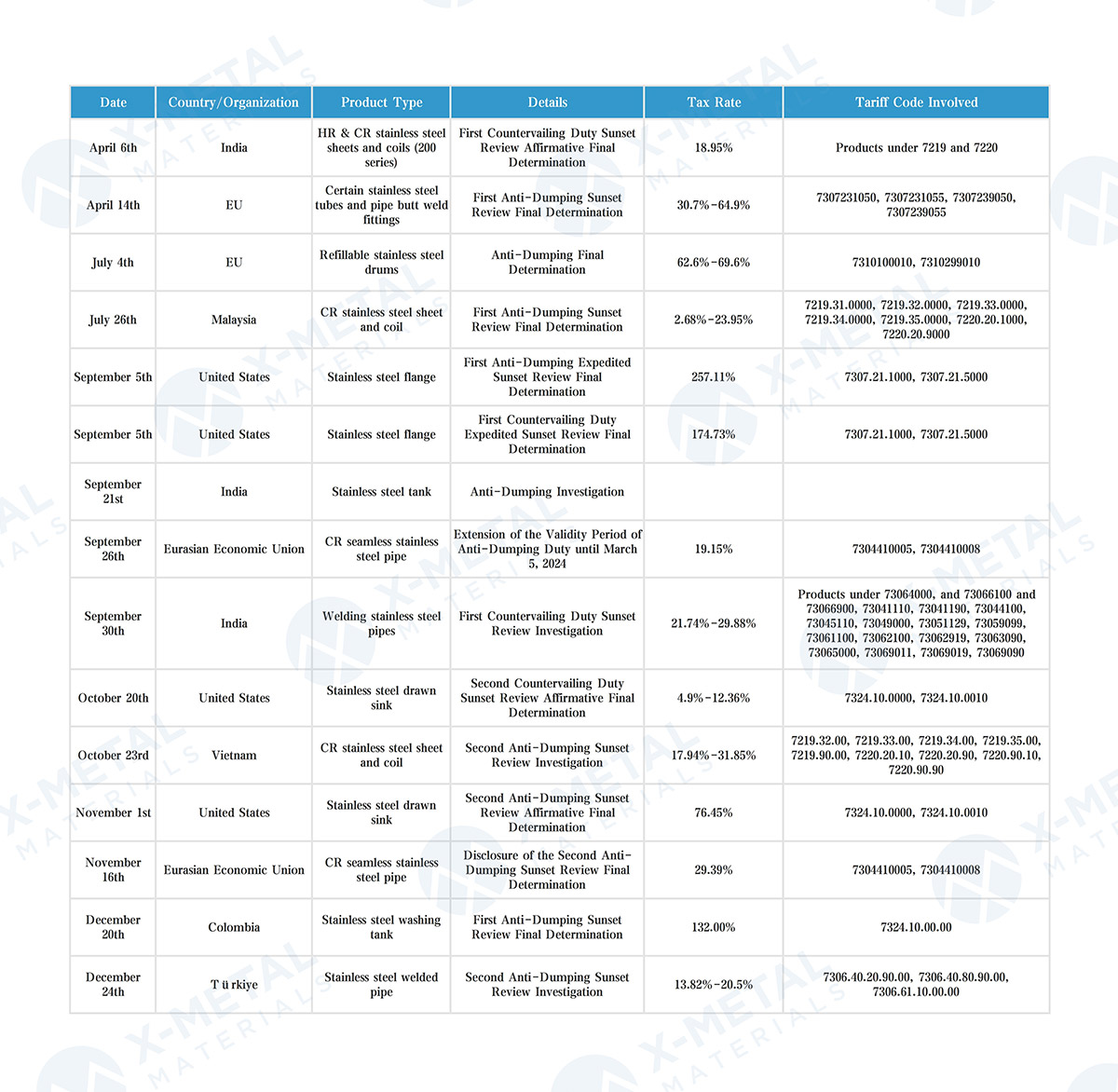

According to incomplete statistics, there were about 15 foreign initiated anti-dumping and countervailing investigations or rulings against Chinese stainless steel products and goods in 2023. The involved products included cold-rolled stainless steel coil and sheet, cold-rolled seamless stainless steel pipes, welded stainless steel pipes, hot-rolled stainless steel plates and coils, stainless steel pipe fittings, flanges, sinks, containers, and barrels. Details as shown below:

3. Overseas Anti-Dumping/Anti-Subsidy Duties on Chinese Stainless Steel Coil and Sheet

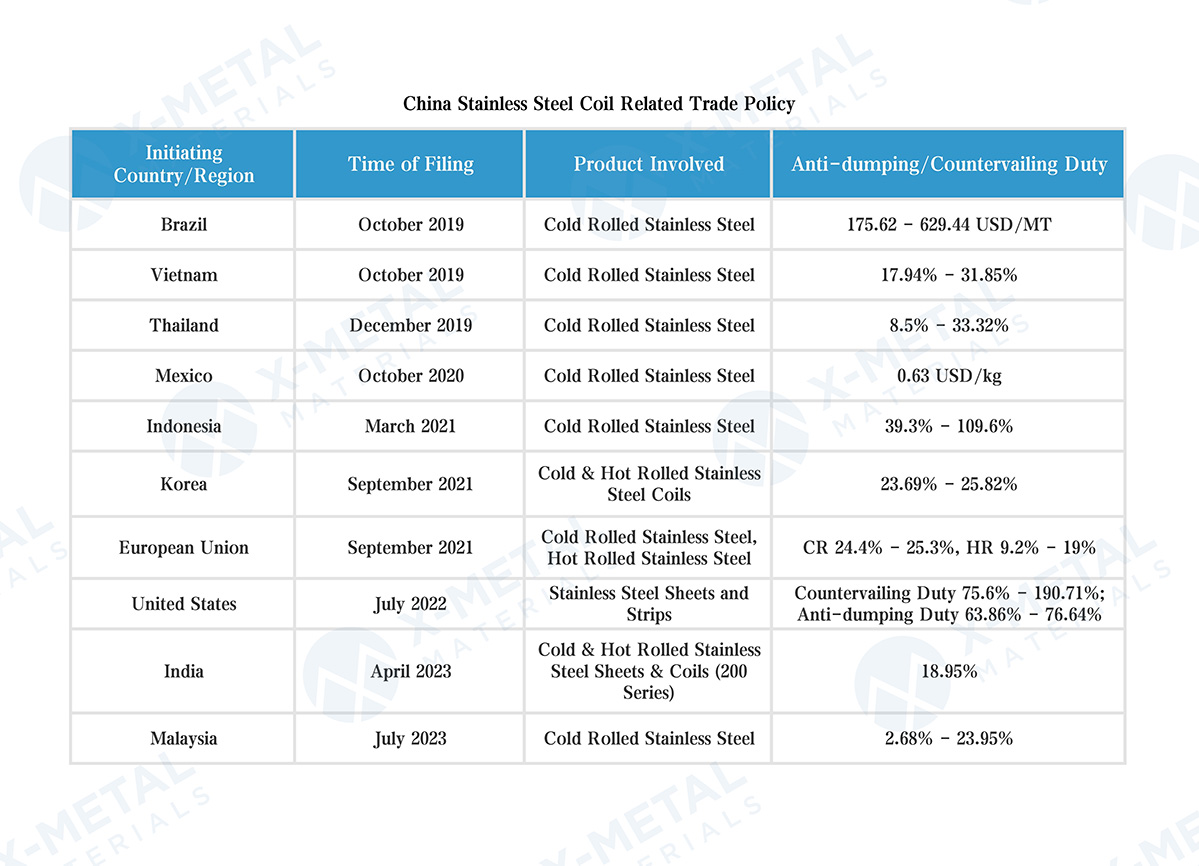

Countries imposing anti-dumping/anti-subsidy duties on Chinese stainless steel include the European Union, the United States, South Korea, Indonesia, Mexico, Thailand, Vietnam, Brazil, Malaysia, India, the Eurasian Economic Union, and Colombia. The products involved cover hot-rolled and cold-rolled stainless steel coil and sheet, pipeline fittings, flanges, seamless pipes, welded pipes, sinks, and barrels.

From January to November 2023, coil and sheet were the primary export products of mainland China, accounting for 77.5% of the total export volume, amounting to about 2.945 million tons. Incomplete statistics show that the current situation of overseas anti-dumping/anti-subsidy duties against Chinese stainless steel coil and sheet is as illustrated in below figure:

4. Outlook for 2024: Potential for a Modest Increase in Exports Amid Global Challenges

The stainless steel market in Europe in 2023 was one of the weakest in recent years, with many companies reducing production in response to challenges. Although energy prices have declined, production recovery remains slow, and demand is not expected to improve significantly in the first half of the year. Europe, as the second-largest stainless steel consumption market after Asia, directly or indirectly impacts China’s stainless steel exports with its weakened consumption.

Looking ahead to 2024, as inflation slows in most countries, there is a gradual resurgence in stainless steel demand. India and Russia, with policy support and demand release, are anticipated to become growth areas for China’s stainless steel exports. The exports are expected to increase by about 3% year-over-year.

Post time: Jan-17-2024